Pengguna iPhone belakangan ini mengeluhkan tidak bisa mendownload dokumen pada Whatsapp. Kasus ini sering terjadi bahkan tidak bisa download foto, video atau pesan suara.

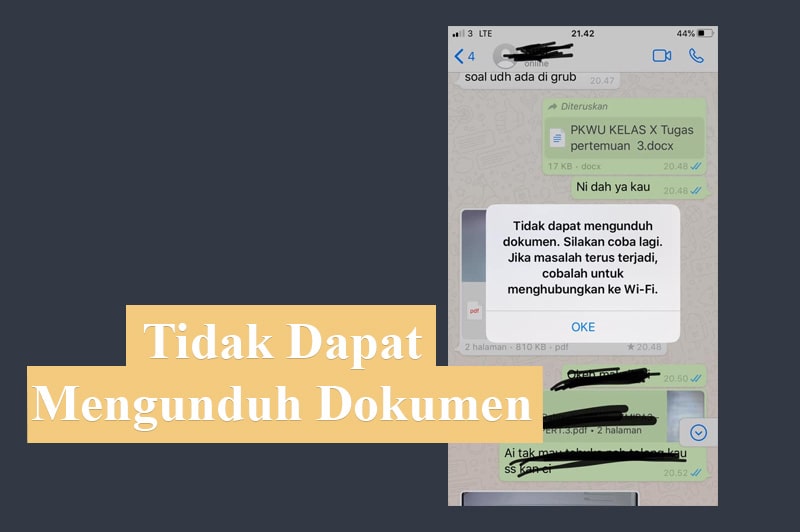

Pesan seperti Tidak dapat mengunduh dokumen. Silahkan coba lagi. Jika masalah terus terjadi, cobalah untuk menghubungkan ke Wi-Fi. muncul ketika ingin mendownload file dokumen yang dikirim via whatsapp.

Kadang kala masalah ini terjadi setelah anda menggunakan Wi-Fi, padahal sebelum menggunakan wifi tidak ada masalah pada WA dan tidak ada masalah No SIM pada kartu dan jaringan.

Walaupun pengaturan telah dicek satu persatu seperti settingan whatsapp, pengaturan tanggal dan jaringan pada data and storage, melakukan reset iPhone dan melakukan restart kadang tidak membuat masalah ini clear.

Masalah wa tidak bisa download dokumen masih terjadi.

Solusi

Untuk mengatasi masalah tidak bisa download dokumen pada wa adalah dengan cara menginstall VPN.

Masalah ini adalah solusi yang kami dapatkan setelah masalah wa tidak bisa download alhasil dengan menggunakan VPN masalah ini bisa teratasi. Install dan aktifkan VPN di iPhone dan buka kembali pesan wa yang bermasalah.

Banyak sekali aplikasi VPN yang ada di iPhone atau Android yang bisa kamu gunakan.

Anda bisa menggunakan vpn pada list berikut ini:

Semua VPN diatas bisa kamu gunakan dan wa anda sekarang tidak bermasalah.

Saran kami untuk menonaktifkan VPN setelah masalah anda telah selesai. Karena penggunaan vpn tidak disarankan diwaktu yang lama. Bisa jadi beberap aplikasi meninggalkan jejak mencurigakan sehingga anda harus login aplikasi ulang, dll.

Bisa jadi karena masalah bug system sehingga Whatsapp tidak bisa mendownload dokumen, apalagi anda baru mencoba iOS terbaru dan harus menunggu update dari aplikasi jika memang masalah dari bug iOS dengan software yang berjalan.

Semoga artikel ini bermanfaat dan tidak ada masalah lagi yang terjadi dengan iPhone anda dan anda bisa berbagi pesan dan dokumen dengan cepat dan mudah dengan aplikasi WA yang sangat populer yang dimiliki oleh Mark Zukerberg.