WhatsApp adalah salah satu alat komunikasi yang sangat banyak digunakan. Perkembangan WA yang cepat, mudah dan tanpa iklan membuat aplikasi ini banyak sekali digunakan. Namun bisa jadi untuk mengurangi beban hidup, kadang anda ingin menonaktifkan WA sementara. Siapa tau.

Hiruk-pikuk media sosial kadang membuat kita stress dan ingin istirahat sejenak, menonaktifkan sosial media, menghilangkan segala noise dunia maya, seperti kali ini kita akan coba mematikan WA sementara, tanpa harus menguninstall aplikasi terutama pada iPhone.

Ikuti langkah dibawah ini untuk memulai.

- Buka Settings

- Scroll kebawah hingga anda menemukan aplikasi WhatsApp

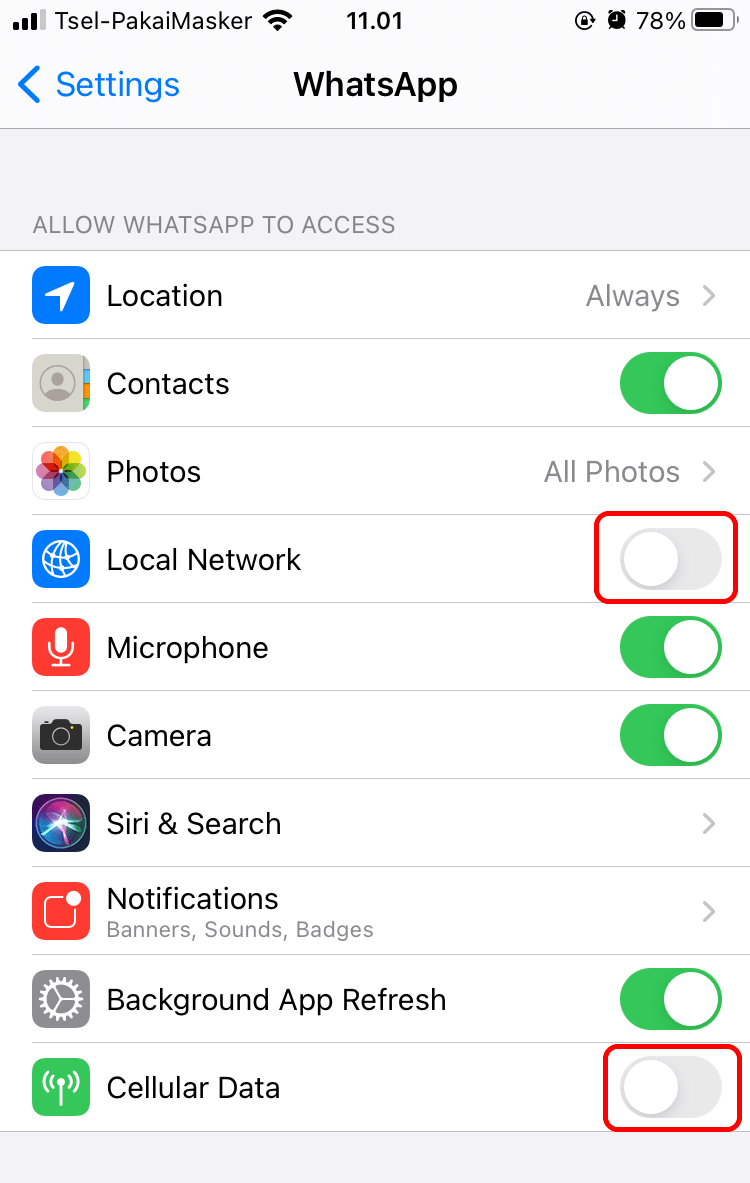

- Matikan dengan menekan pada tombol hijau pada bagian Local Network dan Cellular Data

- Sekarang tidak akan ada lagi pesan yang masuk ke WA anda

Cara diatas akan mematikan wa untuk sementara, tidak ada pesan yang masuk sehingga tidak ada kebisingan di smartphone anda.

Sangat mudah untuk memonaktifkan sementara WA, tidak perlu cara khusus anda bisa melakukannya dengan cara ini. Cara ini juga biasa mengatasi masalah dokumen yang tidak terdownload di wa, dan beberapa bug kecil yang kadang perlu cara ini untuk diselesaikan.

Jika menu diatas tidak ada, silahkan ikuti langkah dibawah ini.

- Buka Settings

- Pilih Cellular

- Scroll kebawah dan nonaktifkan WhatsApp. Cara ini membuat WA anda tidak menerima jaringan dari kartu jaringan, atau jaringan internet dari kartu hp.

Tips ini juga sering dilakukan oleh orang yang berpacaran, sedang ribut dan tidak ingin diganggu maka dengan solusi diatas, terutama pada Smartphone iPhone anda, maka pesan doi dan orang lain tidak akan masuk lagi