Sama seperti WhatsApp, Telegram juga salah satu aplikasi yang sangat populer yang banyak digunakan. Telegram menggunakan nomor handphone sama seperti WA dan akan mensinkron kontak yang ada di iPhone atau Android anda yang otomatis menjadi teman di aplikasi chat tersebut.

Anda bisa menghilangkan atau menyembunyikan nomor anda dari orang lain. Sehingga daftar kontak tidak bisa melihat nomor anda, atau orang lain tidak bisa menambahkan nomor telfon anda ke daftar kontak telegram mereka.

Daftar isi

Menyembunyikan Nomor HP Pada Telegram

Silahkan ikuti langkah-langkah dibawah ini untuk menyembunyikan nomor hp di Telegram.

- Buka Telegram

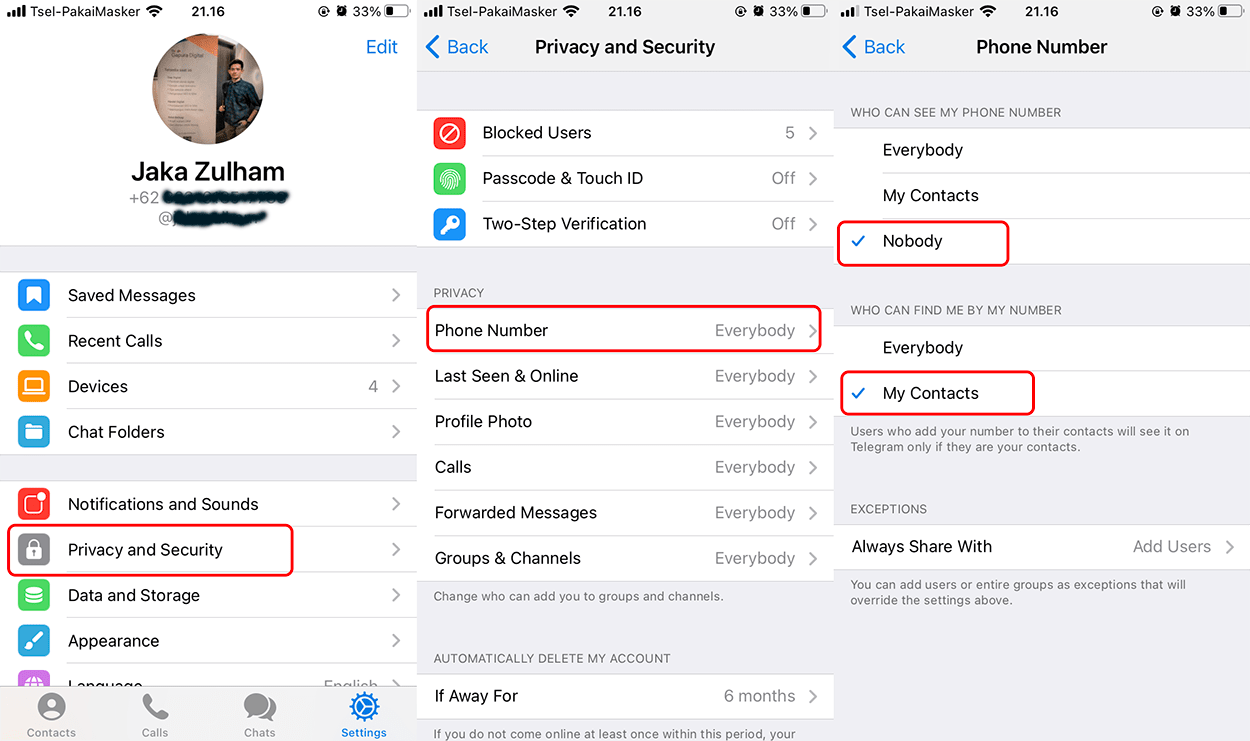

- Masuk ke Settings > Privacy and Security

- Dibawah Privacy, pilih Phone Number, lalu dibawah Who can see my phone number pilih Nobody

- Dibawah Who can find me by my number pilih My Contacts

Dengan cara ini, maka otomatis orang lain tidak bisa melihat nomor telfon anda dan tidak bisa juga mengakses nomor dikontak anda.

Dengan cara ini maka privacy anda menggunakan telegram lebih terjaga, tidak banyak spam yang masuk dan anda tidak perlu menonaktifkan sementara Telegram anda.

Menyembunyikan Nomor HP Pada Orang Tertentu

Beberapa orang mungkin anda tidak ingin privacy anda diketahuinya, hilangkan saja nomor anda darinya, jadi dia tidak bisa melihat nomor utama kita dan kita bebas menggunakan Telegram tanpa terbuka identitas.

Ini sering terjadi, apalagi anda sering buka group-group aneh di Telegram.

- Buka Telegram

- Masuk ke Settings > Privacy and Security

- Dibawah Privacy, pilih Phone Number,

- Dibawah Exception, pilih Never Share With

- Pilih daftar kontak yang ingin disembunyikan, tekan Done jika sudah

Sekarang nomor yang telah anda pilih, tidak bisa lagi melihat nomor handphone anda, anda hanya berkawan dengannya di telagram, tanpa diketahui nomor kontak anda.

Jika memang sudah tidak diperlukan lagi, blokir saja yang sering nyepam!

Memblokir Nomor HP Pada Telegram

Beberapa orang mungkin akan sangat mengganggu anda. Blokir adalah solusi terbaik untuk orang-orang yang bising, membuat kepala pening. Silahkan lakukan jika anda rasa perlu.

- Buka Telegram

- Masuk ke Settings > Privacy and Security

- Masuk ke Blocked Users

- Pilih Block User… dan pilih orang-orang yang ingin anda blokir

- Otomatis dibawah anda akan melihat daftar yang sudah di blokir, dia tidak bisa lagi mengirim anda pesan

- Swipe ke kiri (pengguna iPhone) untuk membuka blokir atau unblock dan anda bisa chat lagi dengan dia

Telegram adalah aplikasi yang sangat mudah dan nyaman digunakan untuk chat-chat, banyak fitur dari pada WhatsApp. Tapi dengan keterbukaan itu, banyak sekali spam yang ada di Telegram.

Blog adalah solusi!

Kesimpulan

Tidak ada sistem yang aman didunia ini, termasuk aplikasi chat seperti Telegram, selalu banyak group baru yang terbuat oleh spam, membuat kita pening dengan hal tersebut.

Menyembunyikan nomor handphone kita dari aplikasi ini adalah salah satu cara untuk meminimalisir spam yang ada, menjaga privacy, dan tentu untuk bersocial media yang lebih nyaman. Sehingga jika ada orang yang melihat akun telegram kita, makan tidak akan tampil nomor telfon.

Batasi pengguna lain untuk melihat privacy kamu, mungkin kamu sudah lelah dengan pekerjaan sehari-hari, tidak perlu dibisingkan oleh pengguna tidak bertanggung jawab di Telegram, sembunyikan bahkan blokir saja orang tersebut.